-

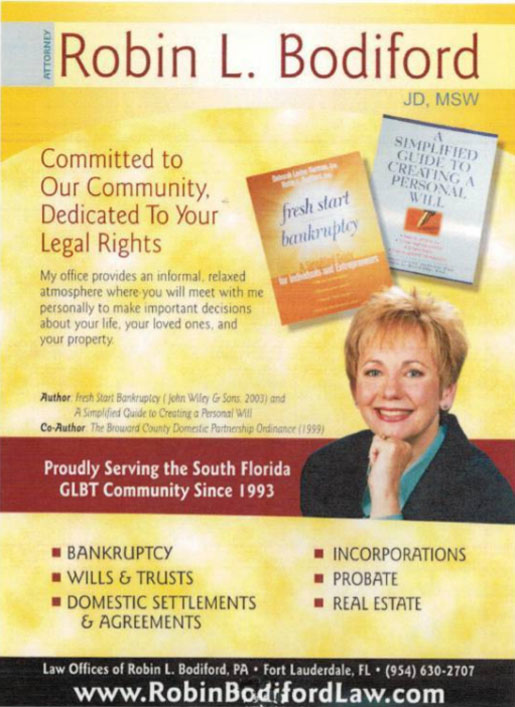

Submitted by Robin L Bodiford, M.S.W., J.D.

During this time of financial upheaval more people find themselves in untenable financial circumstances due not just to lack of money management and over spending, but to job loss, medical bills, loss of a partner, or other unexpected changes in your life. But, if you are like most people, filing for bankruptcy is the last thing that enters your mind as a solution.Danger signs and Mistakes to avoid:

In the normal course of the downward spiral of financial chaos you may find yourself so far in debt that you are only paying the minimum due on your credit cards. Next, you are transferring balances to lower interest rates, taking cash advances to pay for your costs of living, or worse, to pay the minimum balances on the outstanding credit cards. Often clients refinance their homes and use any equity they have in the home to pay off outstanding credit cards thus, turning unsecured credit card debt into a debt secured by your home that you must pay off if you wish to keep your home. Liquidating retirement assets to pay off unsecured credit card debt is the next seemingly logical tactic to try to free yourself from crushing consumer debt: Again, a bad idea, as you are turning an exempt asset (one that creditors cannot take from you) into a non-exempt asset, cash, that you throw down the omnivorous hole that is your mushrooming consumer debt. Debt which is inexorably fed by penalties and unconscionable interest rate hikes by the credit card companies who lobbied Congress to remove usury laws that, in the past, protected consumers from outrageous interest rates.

Next, you may borrow from your family, and friends, if you can. And finally, long before bankruptcy enters your mind, you will consider signing up for a debt consolidation company that promises to negotiate with your creditors and consolidate your payments with you paying a huge chunk of your monthly budget into the consolidation plan: of course right off the top they take the first hefty chunk for their fees.

Only when, despite all your honest and best efforts, you are sued by your creditors, and your "representative" from the consolidation company cannot explain why you are getting judgments against you, your wages garnished, your bank accounts frozen, do you consider the unthinkable: Bankruptcy? Should I talk to an attorney?

Bankruptcy is a federally sanctioned opportunity for you to turn your life around so you can get a fresh start. If you qualify for a Chapter 7 discharge of debts, you may keep your home and its equity, most, if not all, of your personal property, and your consumer debt, medical debt, and most other debt is wiped out. If you have non-exempt assets, such as investment property you wish to keep, or nonexempt financial assets , you may qualify as a Chapter 13 debtor, where some of the debts are wiped out and you make a reasonable plan for repayment over a 3 to 5 year period, where you will find that you can clean up your finances with dignity and closure.